Find high-net worth clients, increase fund awareness and safeguard your reputation with a proven SEO strategy.

We deliver innovative website, SEO, and content strategies – grounded in timeless marketing principles – to help financial services companies get in front of investors ready to spend.

The financial services market is expected to double in the next 10 years. If you’re not ranking well in search engines you could miss out on billions of invested dollars.

Financial services firms face immense competition not only from local firms but also from national players and directories like Investopedia and financial comparison sites. This industry is one of the most competitive in the digital space, but the reward for securing top positions in the SERPs can translate to significant gains in new clients and assets under management.

Approximately 90% of individuals seeking financial services begin their research online, utilizing search engines and social media platforms.1 This underscores the critical importance of a robust online presence for financial institutions aiming to attract and engage potential clients.

Why do financial service companies need SEO?

SEO is one of the lowest cost-per-acquisition channels you can have when trying to reach potential clients at scale. It is an “always on” revenue channel that can help lower the cost of your other marketing programs.

For instance, your clients will leverage search engines to:

- Learn about new methods of investing.

- Learn about finance, how to invest and other thought leadership.

- Do research on who has the best interest rates for their savings accounts.

- Do research on what wealth management firms have the best reputation.

- Find local branches for your bank, credit union or advisor.

- Find new companies they want to invest in through the stock market.

If you have a bad reputation in organic search or you’re not showing up when it matters you are leaving millions of dollars for everyone else to claim who is investing in organic search.

What does a financial SEO strategy look like?

Many think just building a website is enough for SEO and to rank well in organic search – that couldn’t be further from the truth. It’s about creating an “always on” funnel of new clients.

Tech Audits can help you by focusing in the following areas:

- Technical SEO – making sure you have a technically sound website.

- Content Strategy – making sure you have the right content to not just drive traffic but also convert.

- Competitive Analysis – making sure you know what your competitors are doing, building and adapting your strategy to compete.

- Reputation Management – making sure when your clients are reviewing you they are seeing exactly what you want them to see (no negative PR).

An effective SEO program can impact multiple areas of your business and multiple channels – email, paid, social can all be influenced by leveraging data from search and the insights you can learn leading to an increase in revenue across the board.

TechAudits can take your brand to the next level.

Finance is a competitive industry. We can help.

We have extensive experience helping financial institutions drive qualified traffic and increase revenue in a sustainable manner.

Private Equity

Wealth Management

Accounting

Banks / Credit Unions

Insurance

Financial Advisors

Have questions about working with an SEO company?

We have answers. The team behind TechAudits has been working in or around the financial space for the better part of the last 10 years. We have experience working with mortgage lenders, wealth management firms and private equity who manage billions in assets.

We are certain that if you partner up with TechAudits you will see a strong return for all of the effort.

Financial services SEO is the practice of optimizing a financial institution’s online presence to enhance visibility in search engine results and attract targeted traffic. This type of SEO is crucial for achieving growth and building a strong online reputation.

You should expect:

- Sustainable Growth: SEO helps drive qualified, long-term traffic to your site, supporting sustained growth.

- Targeted Traffic: Reach potential clients actively searching for your services, whether you offer B2B or B2C financial solutions.

- Cost-Effective Marketing: Establishing SEO as a marketing channel provides a strong return on investment compared to other advertising methods.

- Increased Brand Awareness and Credibility: High search rankings help build trust and position your brand as an industry leader.

SEO for financial companies involves navigating unique challenges and seizing industry-specific opportunities.

Key considerations include:

- Regulatory Compliance:

- The stringent regulatory environment dictates how financial information is presented and marketed.

- Content must be optimized for search engines while adhering to legal and ethical standards.

- Balancing SEO practices with compliance requires specialized expertise.

- Website Security and Data Protection:

- Financial websites handle sensitive client information, making strong security and data protection essential.

- Technical SEO should include measures that enhance website security and user trust.

- Complex Products and Services:

- Financial products often require detailed, authoritative content to rank well and meet user needs.

- High-quality content helps build trust with consumers who are often cautious and skeptical.

- Trust and Credibility:

- Establishing trust is crucial in the financial sector, where consumers are discerning and expect transparency.

- A trusted SEO partner should craft strategies that convey authority and reliability.

Choosing an SEO partner who understands the diversity of the financial industry and can create adaptive, compliant SEO strategies is vital for success.

Reputation management is crucial for financial services companies due to the high stakes involved in their industry.

You should deploy a reputation management strategy because:

- Trust and Credibility:

- Financial institutions rely heavily on trust to attract and retain clients.

- Negative online content, such as bad reviews or critical articles, can erode public confidence and harm your brand’s reputation.

- High Competition:

- The financial sector is intensely competitive, with firms vying for the attention of discerning clients.

- A strong, positive online presence helps differentiate your company and reinforces its reliability and authority.

- Impact on Business Growth:

- Client acquisition and retention are directly influenced by your company’s reputation.

- Studies show that most clients will research a financial institution online before choosing to engage with it. A poor reputation can deter potential clients and hinder growth.

Benefits of a Strong Reputation Plan

- Improved Brand Perception: Proactively managing your online reputation ensures that positive content outweighs negative mentions, shaping how your firm is perceived.

- SEO Synergy: Reputation management works hand-in-hand with SEO, pushing positive content higher in search results and suppressing unfavorable content.

- Crisis Mitigation: Quick, strategic responses to potential reputation threats help minimize long-term damage and protect your brand.

- No Negative PR: Bury negative results in organic search so when user’s search for you, your brand or even your executives they see the narrative you want.

For financial services companies, maintaining a strong, trustworthy reputation is non-negotiable. Effective online reputation management not only preserves credibility but also supports long-term client relationships and business growth in an increasingly digital and competitive market.

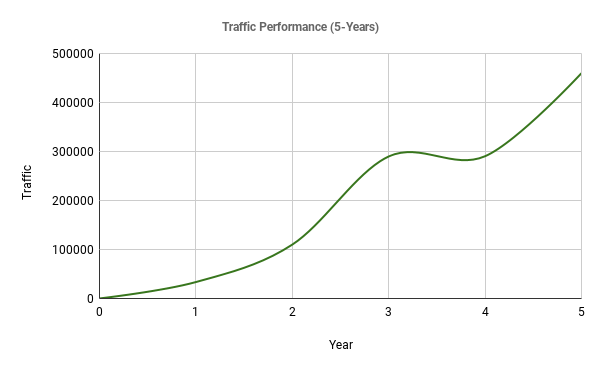

Your optimization efforts will pay off, but the results may not be immediately visible. While you might notice some initial progress within a couple of months, significant changes — like climbing up the search rankings — often takes around three to six months.

An effective SEO strategy will align with your business goals, helping you maximize your search visibility and reach more potential clients.

This strategy should make use of the following tactics:

- Keyword Research: It’s critical for financial services companies to find the terms that potential clients are using to search for financial services, including both general terms and long-tail, geo-specific keywords that capture local search intent.

- On-Page Optimization: All elements of a financial services website, such as title tags, meta descriptions, headers, and content should be optimized with relevant keywords without compromising readability and user experience.

- Technical SEO: Technical issues can stop Googlebot in its tracks and keep Google from indexing your site.

- Quality Content Creation: Authoritative and informative content that addresses common financial questions and showcases your company’s expertise can help improve your organic search engine rankings and user engagement.

- Link Building: Acquiring high-quality, authoritative backlinks from reputable sources within the financial industry and related business communities can significantly boost a financial services firm’s search engine credibility and rankings.

- Performance Tracking: Gain insight into your strategy’s effectiveness with tools like Google Analytics and Google Search Console. Monitor website traffic, user behavior, and conversion rates to see where adjustments may be needed.

- Continuous Improvement: SEO is not a one-time task but an ongoing process. An adaptable strategy is key for long-term success.

By integrating these elements into a cohesive strategy, financial services firms can enhance their online presence, attract more targeted traffic, and ultimately convert that traffic into new client engagements.

An SEO agency for financial services will guide you in identifying the most relevant metrics aligned with your firm’s objectives, allowing you to monitor the right KPIs. Here are some common metrics used to gauge SEO success:

- Search Rankings: Monitor your firm’s search engine positions for targeted keywords relevant to financial services. This metric reflects the immediate impact of your SEO efforts on online visibility.

- Website Traffic: Analyze the flow of visitors to your site, focusing on those coming from organic search. Use tools like Google Analytics to gain insights into both the quantity and quality of your visitors.

- Lead Generation: Track the number of inquiries from potential clients that your website generates. Compare this figure to the baseline established before your SEO campaign began to measure growth.

- Conversion Rates: Assess how effectively your site converts visitors into leads. An increase in conversion rates indicates that your site is successfully attracting the right audience and motivating them to take action.

- Client Acquisition: Evaluate the number of clients your firm acquires through SEO efforts. Are the clients you’re attracting aligned with your firm’s desired client profile?

- Local Search Visibility: Measure your firm’s performance in local organic search results. Ideally, your firm should appear prominently in local directories and on platforms like Google’s Map Pack to capture local market attention.

By keeping track of these metrics, financial services firms can gain a comprehensive view of their SEO campaign’s performance and make data-driven decisions to refine their strategy and maximize ROI.

in organic traffic

in qualified leads

See how TechAudits helped a legal brand convert a paid strategy into a dual paid + organic play driving millions in additional revenue

A legal lead generation website was operating with a paid only strategy and wanted to expand their footprint into organic search to lower their advertising costs. This led to a multi-year campaign driving over $30M in legal fees.